The big headline that’s making the rounds is that folks are spending $1000 a month on a car payment. Yes, the market sucks, and cars are more expensive than ever, but that doesn’t mean you have to be stuck with a four-digit car note.

First, let’s discuss why looking at rising “average” payments isn’t all that scary, and frankly isn’t all that helpful. You take a large sampling of monthly payments and divide by that number to get your average, which is currently sitting around $700 per month. Now you may remember that if you throw in a big number within your sample your “average” is going to skew higher. For example, if we use 24, 55, 17, 87, 100, and 250 we get an average of 88.8.

There is a relationship between those $1,000 monthly payments and an increase in the average payment that a lot of outlets are missing and it’s the fact that wealthier buyers are pivoting to buying cars instead of leasing them because right now leasing is generally a bad idea from a mathematical perspective.

In previous markets you would have folks leasing luxury cars like a BMW X5 for around $800 a month, now those folks are financing those vehicles instead and looking at those four-figure payments. Because this is more common those more expensive cars that are now being financed are skewing the average payment upwards. Of course, rising interest rates and transaction prices over MSRP are also playing a role as well, but not to the same degree.

This brings me to the next point: That these “average” numbers aren’t helpful at all for you as an individual buyer. Just because the “average” person is spending $700 per month on a loan doesn’t mean that is appropriate for you. Advice columns will simply say “don’t buy more than you can afford” but they don’t give you the steps to figure that out.

The first step is to understand what a comfortable monthly payment looks like. There is no hard and fast formula here, some say no more than ten percent of your net monthly income but different people have different thresholds. What buyers need to do is have an honest handle on how much money is coming in every month, how much is being spent on various expenses, and what portion of that would be comfortable for them to spend on a car. The other factor is how much that buyer has in cash to use as a downpayment and there is a balancing act between keeping your payments down and having liquid assets on hand.

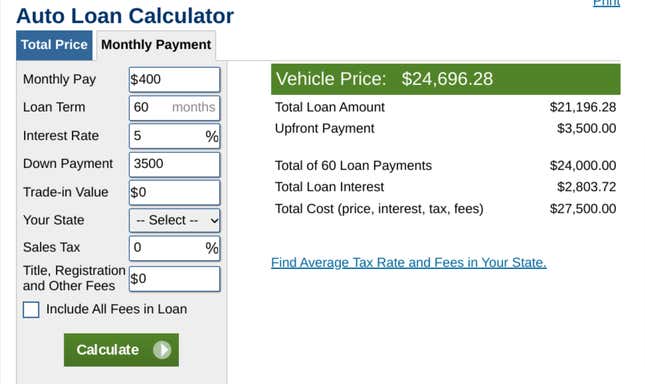

Once you have that comfortable payment and down payment in mind the next step is to calculate affordability. Again we need to go back to math class and fire up that handy calculator, or in this case an online calculator that will help us set a budget. I use Calculator.Net and select their Auto Loan tool. You click the monthly payment tab and plug in the payment that works for your budget.

You can even factor in a down payment, interest rate, local sales tax, dealer fees, and so on. For this exercise, I kept it simple and targeted a $400/mo payment with a 60-month loan at five percent APR using $3500 down. This gives me a total spending limit of about $24,7000. Therefore, when I am researching and sourcing potential cars I should not be looking at vehicles that retail over $25,000 as those are going to be beyond my budget.

This all seems super simple and it is. Other “hacks” like shopping your rates, refinancing, and getting pre-approved are all smart moves to get a competitive car loan are all worthwhile. The problem is that too many buyers get a car loan that is stretching their finances and act like it was beyond their control. The reality is that if you are paying too much for a car loan, it’s likely because you didn’t do the math in the first place.

Tom McParland is a contributing writer for Jalopnik and runs AutomatchConsulting.com. He takes the hassle out of buying or leasing a car. Got a car buying question? Send it to Tom@AutomatchConsulting.com