Almost every week I’ll come across some new article full of “tips” on how to navigate this terrible car market. Some less-informed outlets keep bringing up leasing as a solution to the problem. Let’s examine some common arguments in favor of leasing, and explain why, in reality, it’s still not the secret hack some people claim it is.

Before I dive into this, let me establish that I am not one of these folks that tells people “never ever lease a car.” There are some circumstances where leasing makes the most sense for a particular consumer. As a professional car shopper, I’ve brokered thousands of lease deals for clients, but I’ve always viewed the lease-vs-buy decision on a case-by-case basis. And in today’s car-buying climate, in almost every instance I’ve seen, leasing just doesn’t make mathematical sense. Yet I continue to see advice articles rehashing outdated arguments in favor of leasing that don’t tell the whole story.

Leasing Myth #1: “You Don’t Have To Worry About Maintenance”

There was a time a few years ago when certain car companies — luxury brands in particular — threw in a few years of free maintenance whether you bought or leased your car. Most of these programs have long since disappeared, but let’s dig into why this isn’t the end-all argument in favor of leasing.

For one thing, the first two or three years of a brand-new car’s life usually require very little in the way of maintenance. Most cars use synthetic motor oil, with a factory-recommended oil change interval between 8,000 and 12,000 miles. Under normal use, you’ll probably only pay for one, maybe two oil changes per year. Unless you like to do burnouts, the tires on your brand-new car should last at least 40,000 miles, and major required service work usually doesn’t arise until after 50,000 miles, when most of these maintenance programs expire. Even then, we aren’t typically looking at thousands of dollars in maintenance. (And if you break something through recklessness or misuse, it’s not going to be covered under your “free maintenance” agreement anyway.)

With regards to warranty, practically every new car has a minimum of three years and 36,000 miles of comprehensive (“bumper-to-bumper”) coverage. So whether you leased a car for three years or bought that car and traded it in after 36 months, your warranty coverage would be identical. Furthermore, these days it’s not difficult to find cars that stay relatively trouble-free to the 100,000-mile mark and beyond. So this concern about a new car suddenly becoming really costly to maintain after the warranty runs out is a bit overblown.

Leasing Myth #2: “You Don’t Have to Worry About Resale Value”

At the conclusion of the typical car, truck or SUV lease, you usually just turn in your vehicle and move on to something else. One of the concerns about buying a car is how much it will be worth when it comes time to trade it in. (Of course, the longer you keep the car you just bought, the better overall value you get out of it.)

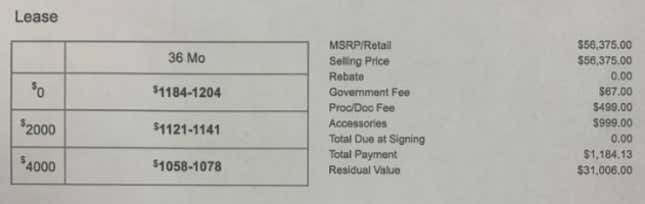

For the sake of comparison, let’s look at leasing a typical vehicle for three years, versus buying that same vehicle and trading it after three years. In either case, you would still pay a depreciation cost, but it’s the total cost over time that matters most. Take for example this Ford F-150 lease:

With an MSRP of $56,375, the lease payments are a whopping $1,184 (or more!) per month. That’s a total three-year cost of $42,624. At the end of the lease, the projected residual value of this truck is $31,006.

If the same customer decided to buy the same F-150 outright, the out-the-door price with all taxes and fees included is right around $60,000. If this customer then re-sold the truck after three years, they’d have spent a total of $28,994. This means the lease would have cost $13,630 more over the same three-year term.

Leasing Myth #3: “Your Payments Will Be Lower”

Historically, lease payments were cheaper because you were only paying for the depreciation of the car. If you had a good combination of high resale, low money factor (a.k.a. interest rate), and a competitive sale price, you would end up with a monthly payment that was substantially lower than a loan.

For folks who wanted a new car but needed to keep their payments on a budget, leasing was a good option. But right now, markups over MSRP are commonplace; paying sticker price is often the absolute best-case scenario on a new car. Combine that with current high interest rates, and the difference between lease payment and purchase payment gets really small.

Let’s look at that F-150 again: We have an out-the-door price of around $60,000. Assuming a 60-month loan at 5 percent APR, that works out to $1,132.27 per month. In this instance, the loan payments are $52 cheaper per month than the lease payments.

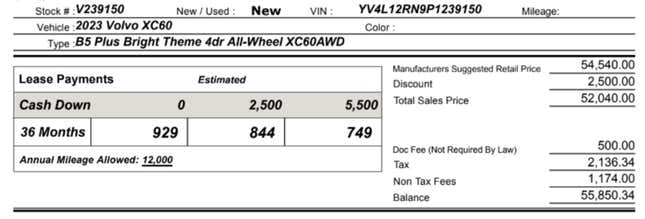

Granted, this is an extreme example. It’s rare for lease payments to be more expensive than a loan, even if we look at something like this $929-a-month Volvo XC60 lease.

A 60-month loan on this car at 5 percent APR would bring the payments to $1,054 per month. You might be thinking that a $129 savings seems worth it, but when leases used to be several hundred dollars cheaper than the finance option, this is a hard sell for the lease.

Let’s Talk About Down Payments and Leasing

Putting a large down payment on a vehicle lease is basically just buying down your monthly payment. The total cost over the term of the lease remains exactly the same. Furthermore, if you end up totaling your leased car in a crash, your down-payment money is gone for good.

If you’re taking out a loan to buy a car outright, your down payment can help establish some equity in the vehicle, making the value of the car greater than the balance on the loan.

It’s a balancing act: Putting some money down on a lease is okay to help keep your monthly payment within your budget, but dropping ten or 20 percent of the MSRP on a down payment certainly isn’t wise.

What About Leasing Electric Cars?

When EVs first hit the market, you could score some incredible deals on leases. Electric cars that retailed in the $40,000 range would have lease payments cheaper than or equal to compacts that retailed for $20,000. The combination of federal and state tax credits, along with serious manufacturer discounts and rebates, made leasing an EV a steal. When consumers considered how fast EVs depreciated (due to rapid advances in battery tech), leasing made even more sense.

In this current market, I’ve yet to see any screaming deals on EV leases. In fact, certain incentive packages make it more logical to buy an EV than to lease: Chevrolet offers factory-to-dealer incentives on the Bolt, but doesn’t apply that price reduction if the car is leased, and Ford won’t pass along the federal tax credit on EV lease programs, bucking a practice that was common among other brands that qualified for the federal credit.

Leasing vs. Buying a New Car: Final Thoughts

Consumers should remember that any lease programs you see advertised (by an automaker or a dealer) is likely engineered to have an enticing monthly payment designed to lure you in the door. Often, the fine print dictates a substantial down payment, and the “special offer” is on a base-model car with no options, a vehicle that might not even be available at the dealer running the ad. If you still aren’t convinced, get the quotes and run the numbers for yourself. Just remember to do the math and look at the big picture, not just the monthly payment.

Tom McParland is a contributing writer for Jalopnik and runs AutomatchConsulting.com. He takes the hassle out of buying or leasing a car. Got a car buying question? Send it to Tom@AutomatchConsulting.com